The cost of ESOPs and their distributions can significantly impact a startup’s financials. This section explores how ESOPs are valued and distributed, along with their potential costs for both the company and employees.

The post 54th GST Council Meeting in 2024: Highlights, Updates, Latest News and Press Release appeared first on Razorpay Learn.

]]>Highlights from 54th GST Council Meeting

As per the Press Information Bureau, here are the following key highlights from the 54th GST Council meeting on 09th September 2024.

Exemption for R&D Educational Institutions

GST Council recommended exempting the supply of research and development services by government entities or research associations, universities, colleges, or other institutions notified under section 35 of the Income Tax Act when using government or private grants.

Reduced GST Rates on Cancer Drugs

The Council recommended reducing GST rates on certain cancer drugs, including Trastuzumab Deruxtecan, Osimertinib, and Durvalumab, from 12% to 5%.

B2C E-Invoicing Pilot

GST Council has recommended implementation of e-invoicing for B2C transactions in a phased manner to prevent cases of false invoicing. This will allow customers to verify their invoices before reporting them while filing GST Returns. Until now, e-invoicing was applicable to B2B transactions for a registered person with a turnover of over Rs.5 crore

Enhancements to the New Invoice Management System

Post the introduction of Invoice Management System, the GST Council proposed other enhancements to the current GST return filing mechanism, such as a Reverse Charge Mechanism (RCM) ledger and an Input Tax Credit Reclaim ledger.

Status Report on Rate Rationalisation and Real Estate

The status reports were duly submitted by the Group of Ministers (GoM) formed on rate rationalisation and real estate, respectively, on the basis of which further discussions regarding the above two subjects will be held in upcoming council meetings.

No Changes to GST On Online Gaming

No changes were announced to GST on Online Gaming. Therefore, as decided in the 50th GST Council meeting held in October 2023, 28% of the GST stands applicable to casinos, games, and race courses.

The status was due to be reviewed after six months of the implementation. The current revenue from Online Gaming had increased by 412% in 6 months to Rs. 6,909 crores from Rs.1,349 crores before the notification was issued, whereas the revenue in case of casinos was increased by 30%, i.e., from Rs.164 crores to Rs. 214 crores.

GoM on Life and Health Insurance

The GST Council recommended the formation of a Group of Ministers (GoM) to study GST related to life and health insurance, which is an extension of the GoM on Rate Rationalisation. The newly formed GoM is required to submit the report by the end of October 2024. Therefore, the GST Council maintained the status quo by keeping the GST rate at 18% on life and health insurance and deferring it to the next meeting. The next GST Council Meeting will happen in November 2024.

Committee of Secretaries for IGST

A Committee of Secretaries under the chairmanship of the additional secretary revenue will be formed to explain and decide on the future of IGST and how to proceed with the same. Given a negative balance in IGST, retrieval process of the excess IGST passed on to some states will be studied. This report has to be submitted by the end of October 2024.

GoM on Compensation Cess

Finance Minister Nirmala Sitharaman stated that the total cess collected amounted to ₹8,66,706 crore. Additionally, she announced the formation of a Group of Ministers (GoM) to investigate and recommend a path forward for the compensation cess, which is scheduled to expire in March 2026. The GoM will study the feasibility of extending the cess or explore alternative funding mechanisms to support states impacted by the GST transition.

GST Rate Changes/Clarifications from 54th GST Council Meeting

| Goods/Service | HSN/SAC Code | Current Rate | Recommended Rate | Remarks |

| Cancer drugs like Trastuzumab Deruxtecan, Osimertinib and Durvalumab | 9804 | 12% | 5% | To make the cancer treatment more affordable |

| Namkeens and Extruded/Expanded Savoury food products | 19059030 | 18% | 12% | The change will be applied prospectively |

| Roof Mounted Package Unit (RMPU) Air Conditioning Machines for Railways | 8415 | 28% | ||

| Car and Motor cycle seats | 9401 | 18% | 28% | The change will be applied prospectively |

| Transport of passengers by helicopters | 9964 | 18% | 5% |

54th GST Council Meeting Press Release Download

Download the 54th GST Council meeting press release issued by press information bureau after the conclusion of the meeting and press conference on 09th September 2024.

GST Rate Changes and Clarifications on Goods

1. GST on Namkeens and Extruded/Expanded Savoury Food Products

In the 54th GST Council meeting, the GST rate on namkeens, extruded, and expanded savory food items like bhujia was prospectively reduced from 18% to 12% except un-fried/un-cooked snack pellets).

2. GST Rate on Cancer Drugs

To make cancer treatment more affordable, the GST Council previously exempted the life-saving drug Dinutuximab (Qarziba), valued at Rs. 36 lakh, from GST. In their 54th meeting, the Council further reduced the GST rate on cancer drugs likeTrastuzumab Deruxtecan, Osimertinib, and Durvalumab from 12% to 5%.

3. RCM on Metal Scrap

A Reverse Charge Mechanism (RCM) will be introduced for the supply of metal scrap from unregistered suppliers to registered persons. The supplier must register when they exceed the threshold limit. The recipient, liable under RCM, will pay the tax even if the supplier is below the threshold. Additionally, a 2% Tax Deducted at Source (TDS) will apply to B2B supplies of metal scrap by registered persons.

Related Read: GST Rates on Steel and Iron Metal Scraps

4. GST on RMPU Air Conditioning Machines for Railways

Roof Mounted Package Unit (RMPU) Air Conditioning Machines for Railways will be classified under Harmonized System (HS) code 8415, subject to a 28% GST rate.

Related Read: GST Rate on Air Conditioners (AC)

5. GST Rate on Car and Motorcycle Seats

The GST rate on car seats under HS code 9401 will be increased from 18% to 28%. This uniform rate of 28% will apply prospectively to car seats of motor cars, aligning with the 28% GST rate for motorcycle seats.

GST Rate Changes and Clarifications on Services

1. GST on Life and Health Insurance Premiums

At present, the GST rate on life and health insurance premiums is 18%. During the 54th GST Council meeting, it was expected that the 18% GST rate would either be exempted or reduced to 5%.

The 54th GST Council recommended the formation of a Group of Ministers (GoM) to comprehensively address GST-related issues concerning life and health insurance. The GoM members include Bihar, Uttar Pradesh, West Bengal, Karnataka, Kerala, Rajasthan, Andhra Pradesh, Meghalaya, Goa, Telangana, Tamil Nadu, Punjab, and Gujarat. The GoM is expected to submit its report by the end of October 2024.

2. GST on Transport of Passengers by Helicopters

The council has implemented a 5% GST rate on the transportation of passengers by helicopters on a seat-sharing basis and to retroactively regularize GST for past periods. Additionally, it’s clarified that chartering a helicopter will continue to be subject to an 18% GST rate.

3. GST on Flying Training Courses

In the 54th GST Council meeting, it was decided to issue a circular clarifying that approved flying training courses conducted by DGCA-approved Flying Training Organizations (FTOs) are exempt from GST.

4. GST on Supply of Research and Development Services

In August 2024, seven Indian educational institutions faced GST notices from the DGGI demanding ₹220 crore in unpaid taxes. Meanwhile, the 54th GST Council meeting exempted university R&D grants from GST.

5. GST on Payment Aggregators

Currently, payment aggregators enjoy a GST exemption for transactions under ₹2,000. This exemption was implemented in 2017 to encourage digital payments for smaller merchant transactions. The 54th GST Council meeting considered imposing an 18% GST on payment aggregators for income from transactions below ₹2,000. However, the decision was deferred and referred to the Fitment Committee for further review.

6. GST on Preferential Location Charges (PLC)

Preferential Location Charges (PLC) paid for construction services of residential, commercial, or industrial complexes before the issuance of a completion certificate are considered part of a composite supply. The main service in this case is the construction service, and PLC is naturally bundled with it. Therefore, PLC is eligible for the same GST treatment as the construction service.

7. GST on Affiliation services

Affiliation services provided by educational boards like CBSE are subject to GST. However, affiliation services offered by State/Central educational boards, educational councils, or similar entities to government schools will be exempt from GST prospectively. Past tax liabilities for the period between 01.07.2017 and 17.06.2021 will be regularized on an ‘as is where is’ basis.

A circular will be issued to clarify that affiliation services provided by universities to their constituent colleges are not covered under the exemptions granted to educational institutions in Notification No. 12/2017-CT(R) dated 28.06.2017. Therefore, these affiliation services are subject to an 18% GST rate.

8. GST on Import of service by branch Office

The GST Council recommended exempting the import of services by a foreign airline company’s establishment in India from a related person or any of its establishments outside India, when such imports are made without consideration. Additionally, the Council recommended regularizing past tax liabilities on an ‘as is where is’ basis.

9. RCM on Renting of commercial property

To prevent revenue leakage, the GST Council recommended bringing the renting of commercial property by unregistered persons to registered persons under the Reverse Charge Mechanism (RCM)

10. Ancillary/intermediate services are provided by GTA

To clarify that when ancillary/intermediate services like loading, unloading, packing, unpacking, transshipment, or temporary warehousing are provided by a Goods Transport Agency (GTA) during the transportation of goods by road and the GTA also issues a consignment note, these services will be considered part of a composite supply. However, if these services are not provided in the context of transportation and are invoiced separately, they will not be treated as part of the composite supply of transportation.

Related Read: Goods Transport Agency Under GST

54th GST Council Meeting in 2024: New Measures

B2C E-invoicing

- The GST Council recommended a pilot rollout of B2C e-invoicing, building on the successful implementation of B2B e-invoicing.

- The Council highlighted potential benefits for retail, such as increased efficiency, environmental friendliness, and cost savings.

- Retail customers would have the opportunity to verify invoice reporting in GST returns.

- The pilot will be voluntary and implemented in selected sectors and states.

Invoice Management System and New Ledgers

- The Council noted enhancements to the GST return architecture, including an RCM ledger, an Input Tax Credit Reclaim ledger, and an Invoice Management System (IMS).

- Taxpayers will have until October 31, 2024, to declare their opening balances for these ledgers.

- IMS will enable taxpayers to accept, reject, or hold invoices for input tax credit purposes.

- This optional feature aims to reduce input tax credit errors and improve reconciliation, potentially leading to fewer notices due to ITC mismatches in returns.

The post 54th GST Council Meeting in 2024: Highlights, Updates, Latest News and Press Release appeared first on Razorpay Learn.

]]>The post GST on Food Items & Restaurants – Rules and Rates on Food appeared first on Razorpay Learn.

]]>GST for food and restaurant services has replaced the old VAT (Value Added Tax) and Service Tax . However, the service charge you pay at a restaurant is not the same as GST; it’s separate.

When it comes to alcoholic drinks, alcoholic liquor is liable to be taxed @ 18% GST. However, GST on alcohol is not charged. State-level VAT in charged on Alcohol.

For example, if you’re at a restaurant that serves both food and alcohol, you’ll pay GST on the food and non-alcoholic drinks, while VAT will be applied to the alcoholic beverages. For everyday food purchases, the GST rates range from 0% to 18%, depending on what you’re buying.

Restaurant Bills Before GST Implementation

Components of the Restaurant Bill Under VAT:

Before the implementation of GST, restaurant bills included multiple components:

VAT: Applied to the food portion of the bill.

Service Tax: Tax on the services provided by the restaurant.

Service Charge: Additional charge by the restaurant, not a tax.

Under the VAT system, different items on the menu were taxed at different rates, complicating the billing process. GST rates on food aimed to standardise this by replacing multiple taxes with a single tax rate applicable to the entire bill.

What were the Original GST Rules for Restaurants?

Restaurants fell under three different rate slabs, when the GST was first launched in July 2017.

With no air conditioning, the GST on restaurants was charged at 12%.

With AC or a liquor license, GST on restaurants was 18%.

For restaurants within five-star hotels, the GST rate was set at 28%

At that time, all Indian restaurants in India could take advantage of the input tax credit. It is applicable when you paid GST while buying supplies for your restaurant, you could subtract that amount from your tax bill.

GST Rate on Food, Restaurant Services, Beverage Services, and Accommodation

Under GST, Restaurants fall under the 5% GST rate, with no option to claim input tax credit (ITC) or the 18% GST rate, with ITC claims.

GST rate is decided depending on the location of the restaurant. For example, a higher GST rate would be applicable for restaurants located within hotels where the room tariff exceeds a specific amount.

The GST rate on restaurant food services is determined based on the type of establishment and other factors.

Type of Service |

GST Rate |

| GST on standalone restaurants, including takeaway (Non-AC) | 5% with No Input Tax Credit |

| GST on standalone restaurants, including takeaway (AC) | 5% with No Input Tax Credit |

| GST on restaurants within hotels (room tariff < Rs. 7500) | 5% with No Input Tax Credit |

| GST on restaurants within hotels (room tariff ≥ Rs. 7500) | 18% with Input Tax Credit |

| GST on outdoor catering services | 18% with Input Tax Credit |

| GST on Quick Service Restaurants (QSR) | 5% with No Input Tax Credit |

| Meals/food services provided by Indian Railways/IRCTC or their licensees both in trains or at platforms. | 5% with No Input Tax Credit |

| Any food/drink served at cafeteria/canteen/mess operating on a contract basis in the office, industrial unit, or by any school, college, etc on basis of a contractual agreement that is not event-based or occasional | 5% with No Input Tax Credit |

| Food services provided on a premise arranged for organizing function along with renting of such premises | 18% |

| Other Accommodation, food, and beverage services | 18% |

Understanding GST Rules for Restaurants

Restaurants in India fall under two broad categories for GST purposes:

Standalone Restaurants

Standalone restaurants, which are not located within hotels and do not provide accommodation services, are generally subject to a 5% GST rate on their services. However, they do not have the option to claim Input Tax Credit (ITC) on the GST paid for their inputs.

This 5% GST rate applies to both food and beverages served by standalone restaurants.

Restaurants within Hotels

Restaurants that are part of hotels where the room tariff is Rs. 7,500 or more per day fall under a different GST category. These restaurants are subject to an 18% GST rate on their services, including food and beverages served. The key difference here is that they can claim Input Tax Credit (ITC) for the GST paid on their inputs, such as raw materials, services, and other supplies used in providing the restaurant services.

Note: GST rates are subject to periodic changes.

GST Rate on Food Items

Products |

GST Rate |

| GST on fresh, chilled, frozen vegetables | Nil |

| GST on dried vegetables that are packaged and labelled | 5% |

| GST on dried leguminous vegetables other than pre-packaged and labelled | Nil |

| GST on dried leguminous vegetables that are pre-packaged and labelled | 5% |

| GST on fresh/dried coconuts, grapes, apples, bananas, and pears, among others | Nil |

| GST on fruits like citrus fruits, grapes, pear, apples, bananas, papaya, melons, pears, mangoes, and berries, among others | Nil |

| GST on vegetables, fruits, nuts, and edible plant parts that are preserved using sugar | 12% |

| GST on fruits, nuts, and edible plant parts that are preserved and/or prepared using vinegar and/or acetic acid. | 12% |

| GST on rye other than pre-packaged and labelled | Nil |

| GST on rye, pre-packaged and labelled | 5% |

| GST on pasteurized milk (excluding UHT milk) fresh milk, and milk and cream (not concentrated nor contains added sugar or sweeteners) | Nil |

| GST on milk and cream that is concentrated or contains added sugar or sweeteners | 5% |

| GST on curd, buttermilk, and lassi, other than pre-packaged and pre-labelled | Nil |

| GST on curd, buttermilk, and lassi that is pre-packaged and pre-labelled | 5% |

| GST on yoghurt and cream, whether containing sugar/flavouring or not | 5% |

| GST on fresh or chilled meat and fish | Nil |

| GST on meat that is packaged and labelled | 5% |

| GST on pre-packaged and labelled cereal flours other than of wheat or meslin, rye, etc. | 5% |

| GST on chocolate and food preparations containing cocoa | 18% |

| GST on birds’ eggs in shells | Nil |

| GST on birds’ eggs which are not in a shell | 5% |

| GST on rice other than pre-packaged and labelled | Nil |

| GST on rice, pre-packaged and labelled | 5% |

| GST on wheat or meslin (i.e. maize flour) other than pre-packaged or labelled | Nil |

| GST on pre-packaged and labelled wheat or meslin | 5% |

Related Read: GST HSN Code List

Food Bill Pre and Post GST Era with Example

In the below example, the total amount payable to the tax authorities under the current regime sums up to Rs.950. However, under GST, net outflow from the pocket will be Rs.250, thanks to the reduced rates.

Particulars |

Billing under VAT regime |

Billing under GST regime |

| Total Bill | 5000 | 5000 |

| Output Tax | ||

| VAT @14.5% | 725 | |

| Service tax@6% | 300 | |

| GST @5% | 250 | |

| Total output tax liability | 1025 | 250 |

| Input credit | ||

| VAT ITC (no ITC on ST) | 75 | |

| GST ITC | – | |

| Final Output tax liability | ||

| VAT | 650 | |

| Service Tax | 300 | |

| GST | 250 |

Impact of GST on Food Items and Restaurants

The Goods and Services Tax (GST) has significantly impacted the Indian restaurant industry and the taxation of food items.

Decrease in Effective Tax

Before GST, customers had to deal with various taxes like VAT and Service Tax. With GST, these taxes were combined into a single rate, which led to a slight decrease in the overall cost of dining out. However, this reduction wasn’t very significant, and the service charge at restaurants stayed the same.

Input Tax Credit on Food and Restaurant Services

For restaurant owners, GST was expected to improve their cash flow by allowing them to get back the Input tax credit they paid on things like raw materials and rent. Initially, they couldn’t claim ITC. Although there have been changes since then, restaurants that charge 5% GST on their food services still can’t get these tax credits, unlike those charging 18% GST.

Exemption for Fresh and Frozen Food

As for food items, most fresh and frozen products, like vegetables and meat, are not taxed under GST. Only packaged foods with brand names are taxed. Currently, no food items are taxed more than 18%, and none fall into the highest tax bracket of 28%. So, there haven’t been any major price changes for food items due to GST..

Tax Slabs for Food Items

Food items and food services are categorized under various GST tax slabs, primarily 5% and 12%. This ensures that essential food items are not subjected to high taxation, with a maximum GST rate of 18% applicable to food services provided by restaurants.

Related Reads:

Frequently Asked Questions

How Much GST Tax on Food in Restaurant?

Restaurants without AC are charged at GST of 12%. Restaurants with AC or liquor licenses are charged at 18% GST while Restaurants within five-star hotels are charged at 28% GST

What is the rate of GST applicable on chocolate and cocoa products?

Chocolates and cocoa products have a GST rate of 18%.

Is there GST on takeaway food?

Yes, takeaway food does have GST. The rate can be either 5% or 18%, depending on where the restaurant is located.

What are the GST Rates on Catering Services?

GST rates on outdoor catering services is 18% (with ITC).

Is there a different GST rate for air-conditioned and non-air-conditioned restaurants?

No, there is no difference in GST rates for air-conditioned and non-air-conditioned restaurants under the current GST structure. Both are generally taxed at 5%.

Is GST applicable to packaged and processed food items?

Yes, GST on food items is applicable to packaged and processed food items, with rates generally ranging from 5% to 18%, depending on the type of product.

What is the GST rate on food served in trains?

The GST rate on food served in trains is 5%, irrespective of whether the food is cooked on board or supplied from outside.

What is the highest GST rate applicable on food items?

The highest rate of GST applicable in the food segment is 28%, which is applicable to certain goods such as caffeinated and carbonated beverages.

Are there any food items exempt from GST?

Yes, most fresh and frozen foods like vegetables, fresh fruits, meat, fish, etc. are exempt from GST.

Can restaurants claim input tax credit (ITC) on GST paid?

Restaurants can claim ITC if they charge 18% GST, but not if they charge 5% GST.

The post GST on Food Items & Restaurants – Rules and Rates on Food appeared first on Razorpay Learn.

]]>The post ESOP for Startups in India: Benefits, Legal Framework, Costs, and Taxation appeared first on Razorpay Learn.

]]>What is ESOP?

ESOPs, or Employee Stock Ownership Plans, are benefit plans that empower employees to become part owners of the company they work for by acquiring company stock. By aligning employees’ financial interests with those of the company’s shareholders, ESOPs foster a sense of ownership and motivation. As the company’s value grows and profits increase, employees can directly benefit through the appreciation of their stock holdings.

How Does ESOP Work in Startups?

1. Setting Up an ESOP Trust

- Stock Allocation: Startups typically set aside a specific percentage of their stock for an ESOP.

- Trust Formation: An ESOP trust is created to hold these allocated shares.

- Employee Participation: Employees become eligible to participate in the ESOP based on their role and tenure.

2. Acquiring Shares

- Vesting Schedule: Employees don’t receive shares immediately. Instead, they acquire them over time based on a vesting schedule.

- Gradual Ownership: This schedule ensures that employees are incentivized to stay with the company and contribute to its long-term growth.

3. Benefitting from Share Growth

- Value Appreciation: As the startup’s value increases, so does the worth of shares in the ESOP trust.

- Employee Gains: Employees who hold shares benefit financially from this appreciation.

4. Aligning Interests

- Mutual Success: ESOPs create a strong alignment between employee interests and the company’s success.

- Motivation: This alignment fosters a sense of ownership and motivation among employees.

ESOPs Under Company Law

1. Eligibility for ESOPs

- Employees, Officers, and Directors: ESOPs can be offered to employees, officers, and directors of the company, its subsidiaries, or holding companies.

- Option to Subscribe: The option grants these individuals the right to subscribe to company shares at a predetermined price in the future.

2. Applicability to Companies

- Private Limited Companies: Companies registered as private limited can implement ESOPs by adhering to the Companies Act, 2013, and its rules.

- Listed Companies: For companies with listed equity shares, ESOPs must be issued in compliance with SEBI regulations.

3. ESOP Features

- Discounted Share Price: The option to buy shares at a future date is typically offered at a price lower than anticipated market rates.

- Conversion to Shares: The option can be converted into shares on a specified date by paying the predetermined price.

- Salary Deduction: Employees may opt for a portion of the share price to be deducted from their salary, as outlined in the ESOP agreement.

4. Implementation Process

- Feasibility Study: Companies should conduct a feasibility study to assess the financial viability of implementing ESOPs.

- Shareholder Approval: If the feasibility study is positive, the company should draft an ESOP scheme and obtain approval from its shareholders.

- Letter of Grant: Approved ESOPs are granted to employees through a Letter of Grant, which outlines the terms and conditions of the options.

- Vesting Period: Employees must wait for the vesting period to end before converting their options into shares and becoming company shareholders.

Legal Documents Required for Startup ESOPs

Startups will need the following suite of legal documents to ensure everything runs smoothly and legally:

1. Stock Option Agreements

This contract between the company and the employees grants the right to purchase shares at a set price.

2. Vesting Schedules

These documents outline the timeline for when employees earn their shares.

3. Plan Rules and Guidelines

This rulebook defines eligibility, exercise price, and the plan’s operation mechanics.

4. Board Resolutions

These are formal approvals by the board of directors to implement the ESOP.

5. Employee Communication Materials

These are clear and concise guides that explain how the ESOP works and what it means for employees.

Quick Tips for Opting for ESOPs

When considering ESOPs as part of your compensation package, it’s crucial to approach the offer with a strategic mindset, especially when dealing with startups and listed companies.

Here’s a consolidated guide to help you navigate these offers:

Evaluate the Start-Up Risk

1. Understand the Company’s Growth Potential

Start-up ESOPs can be risky since their value heavily depends on the company’s success. Consider the company’s growth trajectory and market position before agreeing to the offer.

2. Vesting Period and Lock-In

Start-ups often implement a 3-4 year vesting period with a lock-in period of 12-18 months. This means you can’t sell the shares for this duration after they’re allotted. Make sure you’re comfortable with these timelines.

Ensure Proper Documentation

1. Accurate Share Valuation

Verify that the share value is computed correctly. Understanding the basis for valuation is crucial, as it impacts your potential gains.

2. Exit Mechanisms

Look for a clearly defined exit strategy, such as promoter buyback options. This ensures that you can cash out your shares even if the start-up does not go public.

Listed Company Considerations

1. Favorable Vesting and Lock-In Terms

For listed companies, aim for a lower vesting period and avoid lock-in periods if possible. This provides more flexibility in managing your shares.

2. Thorough Review of Terms

Obtain the ESOP scheme brochure and scrutinize the terms, especially around the exercise price and Fair Market Value (FMV) calculation. This will help you understand the financial implications of exercising your options.

3. TDS Deductions

Check whether Tax Deducted at Source (TDS) is accounted for, as this affects your net gains.

Strategic Actions and Negotiations

1. Negotiate Key Terms

If you’re a key employee, leverage your position to negotiate better terms, such as lower exercise prices and faster vesting schedules.

Set Expiry Reminders: Always set reminders for ESOP expiry dates to ensure you don’t miss the window to exercise your options.

2. Consult a Financial Planner

Discuss the ESOP agreement with a financial advisor to understand the best strategies for exercising or selling your shares.

Cost of ESOPs and Distributions

Costs of Implementing an ESOP

1. Administrative Costs

Establishing an ESOP incurs various legal and administrative expenses. These include drafting the plan document, ensuring compliance with regulations, and managing records, which can be substantial for any business.

2. Valuation Costs

Assessing a fair market value for the company’s stock is crucial, especially for young startups. This often requires hiring valuation experts and payroll software for startups, leading to significant costs, vital for ESOP integrity.

3. Potential Dilution

Introducing an ESOP means shares are distributed to employees, which can dilute existing ownership. For instance, if an ESOP is allocated 10% of the company’s stock, a founder’s previous 50% stake could be reduced to 45%.

Distributions From the ESOP

1. Tax Implications

The distribution of ESOP shares can have tax consequences for both the company and its employees, which vary based on jurisdiction and specific tax laws.

2. Cash Flow Considerations

While distributing shares from an ESOP doesn’t directly deplete cash reserves, offering a share repurchase option can affect the company’s liquidity, especially if many employees opt to sell their shares back to the company.

Understanding ESOP Taxation for Employees

Taxability of ESOPs

1. Perquisite Tax

The difference between the fair market value of the shares on the date of exercise and the exercise price paid by the employee is generally taxable as a perquisite in the hands of the employee. However, there may be specific exemptions or deductions available depending on the circumstances and the applicable tax laws.

2. Taxable Event

While it’s true that employees are typically taxed when they exercise their ESOP options, the exact timing and method of taxation can vary depending on the company’s policies and applicable tax laws.

Calculation of Taxable Value

1. Perquisite Value

The company is responsible for calculating the perquisite value of the ESOP and deducting the tax from the employee’s salary. The information on tax deducted from ESOPs is usually mentioned in Form 16.

2. Fair Market Value

The fair market value of the shares on the date of exercise is a crucial factor in determining the taxable perquisite. This value should be determined using a reliable valuation method.

3. Exercise Price

The exercise price paid by the employee is subtracted from the fair market value to calculate the taxable perquisite.

Capital Gains Tax

1. Short-Term vs. Long-Term

When employees sell their ESOP shares at a higher price, the capital gains are generally taxed as either short-term or long-term capital gains, depending on the holding period.

2. Tax Rates

The tax rate for capital gains varies depending on the type of capital gain and the employee’s income tax bracket.

Example of ESOP Calculation

Consider a company valued at ₹50 lakh with 100,000 shares outstanding. If an employee is granted an ESOP for 1,000 shares, their ownership percentage would be 1% of the company.

1. Calculation of ESOP

- Value of ESOP grant = (Total company value / Total number of shares) * Number of shares granted

- Value of ESOP grant = (₹50 lakh / 100,000 shares) * 1,000 shares

- Value of ESOP grant = ₹500

2. Factors Influencing ESPO Calculation and Allocation

- Company Valuation: The company’s total value is crucial as it determines the worth of each share.

- Employee Investment: An employee’s level of investment in the company, either through purchase or as a reward for service, can affect their ESOP allocation.

- Vesting Schedule: The timeframe over which employees earn the right to their ESOP shares encourages long-term commitment.

- Allocation Method: Shares can be allocated equally to all employees or based on performance metrics.

Benefits of ESOP for Startups

1. Talent Acquisition & Retention:

-

Competitive Advantage: ESOPs offer a unique selling proposition in competitive markets, attracting top talent who seek long-term ownership and rewards.

- Retention Incentive: Employees are more likely to stay with a company where they have a vested interest, reducing turnover costs and ensuring continuity.

2. Alignment of Interests

- Shared Vision: ESOPs create a shared sense of ownership and purpose, fostering a unified vision among employees and founders.

- Long-Term Commitment: Employees are more likely to make decisions that benefit the company’s long-term growth when they have a stake in its success.

3. Motivation & Engagement

- Enhanced Productivity: Employees with a stake in the company’s performance are often more motivated to work hard and contribute to its success.

- Innovation and Efficiency: ESOPs can drive innovation and efficiency as employees feel empowered to take risks and experiment with new ideas.

4. Culture Building

- Team Spirit: ESOPs foster a sense of camaraderie and teamwork, creating a positive and supportive work environment.

- Shared Values: Employees are more likely to embrace the company’s values and mission when they feel like they are part of a larger community.

5. Tax Benefits

- Deferred Tax: ESOPs can offer tax advantages through deferred taxation on employee contributions and company profits.

- Retirement Savings: ESOPs can serve as a retirement savings vehicle for employees.

6. Exit Strategy

- Liquidity Event: ESOPs can provide an exit strategy for employees when the company is sold or goes public.

Financial Gains: Employees can benefit financially from the appreciation of their shares when the company is valued.

Benefits of ESOP for Employees

Financial Benefits

1. Ownership Stake

ESOPs allow employees to become part owners of the company, giving them a direct financial stake in its success.

2. Capital Appreciation

As the company’s value grows, employees can benefit from the appreciation of their shares, potentially leading to significant financial gains.

3. Retirement Savings

ESOPs can serve as a retirement savings vehicle, providing a source of income in retirement.

4. Tax Advantages

ESOPs may offer tax advantages, such as deferred taxation on employee contributions and company profits.

Non-Financial Benefits

1. Enhanced Engagement

ESOPs can increase employee engagement and motivation, as employees feel more invested in the company’s success.

Improved Job Satisfaction: Owning a stake in the company can lead to greater job satisfaction and a sense of purpose.

2. Career Development

ESOPs can provide opportunities for career development and advancement, as employees are more likely to be invested in the company’s long-term growth.

3. Sense of Ownership

Being a part owner of the company can foster a sense of ownership and pride among employees.

Disadvantages of ESOPs for Startups

ESOPs can be a double-edged sword for startups. Let’s understand how.

1. Complexity and Administrative Burden

- Legal, Financial, and Tax Implications: ESOPs can be complex to understand and administer, involving various legal, financial, and tax considerations.

- Time-Consuming: Startups may find it challenging to allocate resources to manage ESOPs, especially if they lack expertise in these areas.

- Administrative Costs: Setting up and managing an ESOP can be expensive, involving legal fees, administrative costs, and valuation expenses.

2. Dilution of Ownership

- Founder Dilution: As employees acquire shares through ESOPs, founders may experience dilution of their ownership stake.

- Decision-Making Power: Dilution can affect decision-making power, as founders may have less control over the company’s direction.

- Profit Sharing: Founders may need to share profits with a larger group of stakeholders, potentially reducing their personal financial rewards.

3. Financial Challenges

- Cash Flow Constraints: ESOPs can be financially demanding for startups, especially during the setup and operation phases.

- Cost of Equity Capital: ESOPs can increase the number of outstanding shares, diluting existing shareholders’ ownership and potentially increasing the cost of equity capital.

- Debt Financing: ESOPs may make it more difficult to raise new debt, as lenders may be concerned about the company’s financial health and ownership structure.

4. Vesting and Share Value Fluctuations:

- Vesting Requirements: Employees may lose a significant portion of their ESOPs if they resign or are fired before the vesting period ends.

- Share Value Risk: The value of shares can fluctuate based on the company’s performance, which can make it difficult for employees to plan for retirement.

- Timing of Exit: Employees may need to time their exit carefully to maximize the value of their ESOPs.

What Will Happen to ESOPs When the Company Is Listed?

1. IPO & Liquidity

An IPO marks a company’s entry into the public markets. It allows the sale of shares to the public, creating liquidity for all shareholders, including employees holding ESOPs.

2. Vesting Matters

For employees, the benefit from an IPO is contingent on vesting. Only fully vested ESOP shares will reap IPO rewards. The vesting schedule in the ESOP plan is key.

3. Exercising Options (if applicable)

Employees with stock options must act to gain. They must exercise their options, buying shares at the set strike price. Only then can they sell them on the public market.

4. Potential for Gains

Post-exercise, the profit potential emerges. Employees can sell their vested shares on the stock exchange. The market price may far exceed the strike price, amplifying gains.

Conclusion

Incorporating ESOPs into employee compensation packages can significantly enhance team morale, productivity, and retention. Employees who feel invested in a company’s success are more likely to exhibit a strong sense of pride and loyalty. ESOPs offer employees a higher stake in the company, making them valuable tools for retaining top talent.

Frequently Asked Questions

1. Who is not eligible for ESOP?

Individuals not eligible for ESOPs include part-time employees, consultants, advisors, mentors, and independent directors. Additionally, promoters or those holding more than 10% of the company’s equity shares are excluded from ESOP eligibility.

2. Is an ESOP good for employees?

ESOPs provide employees with a stake in the company. They align employees’ interests with the company’s objective, leading to financial gains. ESOPs can motivate and retain talent, providing a sense of ownership and additional income through dividends or stock appreciation.

3. What are the rules for ESOP in startups?

Startups can offer ESOPs to employees under the Companies Act 2013, requiring approval by a 75% shareholder majority. ESOPs must be at a predetermined value, and the benefit difference is taxable as perquisite under the Income Tax Act 1961.

4. Which Indian startups offer ESOPs?

Flipkart, PhonePe, Udaan, CRED, Spinny, and Zerodha are some startups known for offering ESOPs.

5. How long do ESOPs last?

In India, ESOPs typically have a vesting period of 1 to 4 years. The employer sets the specific duration, which must comply with SEBI guidelines, which mandate a minimum vesting period of one year. Post-vesting, employees can exercise their options within the exercise period.

6. What is the Importance of Legal Compliance and Role of Documents?

Legal compliance and documents are crucial for ESOPs as compliance prevents legal issues, document protects interests and ensures clarity. This transparency further builds trust, retention, and conflict resolution.

The post ESOP for Startups in India: Benefits, Legal Framework, Costs, and Taxation appeared first on Razorpay Learn.

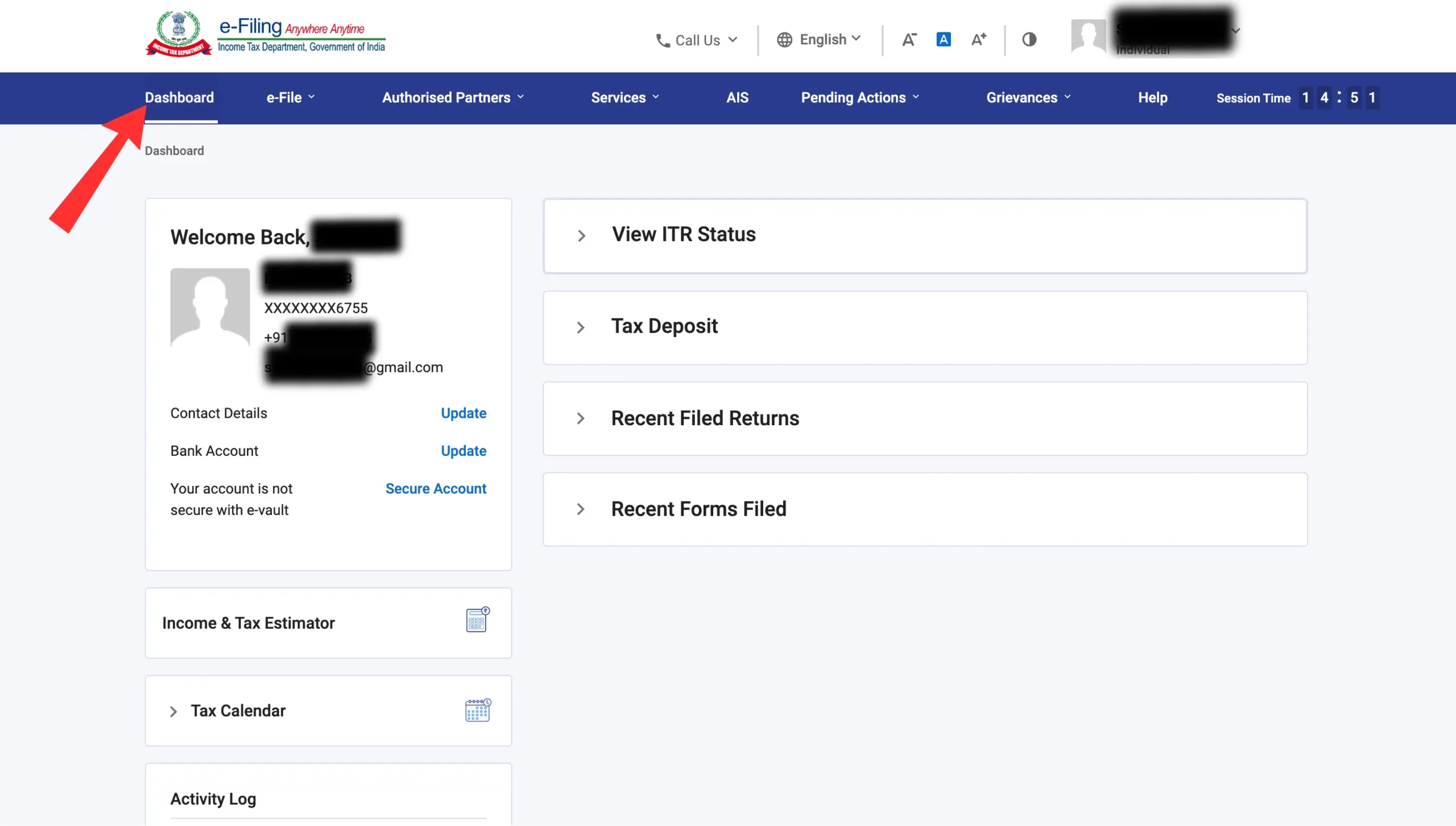

]]>The post GST Registration Online: Process, Eligibility, Limit, Fees, Documents Required & Penalties appeared first on Razorpay Learn.

]]>GST registration is the process of obtaining a unique identification number for a business liable to pay Goods and Services Tax (GST). As per GST law, The firms with an annual turnover of more than Rs. 40 lakh (or Rs. 20 lakh for some special category states) must register as normal taxable entities.

For certain businesses, registration under GST is mandatory. If the organisation carries on business without registering under GST, it is an offence under GST and heavy penalties will apply. GST registration is usually completed within 6 working days.

GST registration is a process by which a taxpayer gets himself registered under GST. Once a business is successfully registered, a unique registration number is assigned to it known as the Goods and Services Tax Identification Number (GSTIN). You can also Verify GST number of any taxpayer to know the complete details.

Please note: If you are operating from more than one state, then you will have to take separate registration for each state you are operating from.

What is Minimum GST Registration Turnover Limit?

The turnover limits for GST registration differ for normal and special category states. The following table summarises the turnover limits for different types of supplies and states:

Type of Supply |

Normal Category States |

Special Category States |

| Goods | Rs 40 lakhs | Rs 20 lakhs |

| Services | Rs 20 lakhs | Rs 10 lakhs |

| Both Goods and Services | Rs. 20 lakhs | Rs 10 lakhs |

The special category states under GST Rules

- Arunachal Pradesh

- Assam

- Jammu and Kashmir

- Ladakh

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Sikkim

- Tripura

- Uttarakhand

- Himachal Pradesh

Who Should Obtain Registration Under GST?

- Casual taxable person / Input Service Distributor (ISD)

- Businesses with turnover above the threshold limit of Rs.40 lakh or Rs.20 lakh or Rs.10 lakh as the case may be

- Agents of a supplier & Input service distributor

- Non-resident taxable person

- Inter-state supplier of goods and services

- Supplier of goods through an e-commerce portal

- Any service provider

- e-commerce aggregator

- Liable to pay tax under the reverse charge mechanism

- TDS/TCS deductor

- Online data access or retrieval service provider

- Individuals who registered under Pre-GST law (i.e., VAT, Service Tax etc)

GST Registration Process

Below is the Procedure For Registration Under GST

One can apply for GST registration in Form REG-01 on the GST portal. The GST registration process involves seventeen steps. These steps include submitting various business details, scanned documents, and filling out form REG-01 on the GST portal.

Follow steps outlined in our articles “How to Get GSTIN Number?” or “How to Register for GST Online?“

Once you have completed the GST registration process, a GST officer will review your application and, upon approval, issues a GST registration certificate containing your GSTIN.

What are the Documents Required for GST Registration?

- Permanent Account Number (PAN) of the applicant

- Copy of the Aadhaar card

- Proof of business registration or incorporation certificate

- Identity and address proof of promoters/directors with a photograph

- Bank account statement/cancelled cheque

- Authorisation letter/board resolution for authorised signatory

- Digital signature

Read More: Documents Required for GST Registration

GST Registration Fees

As per GST law, no fees is required for obtaining GST registration through GST portal independently. That means you can register your business under GST for free without paying any charges to the government.

However, If any GST professional helps you with registration that will incur fees. If you’re comfortable using the GST portal and understand the required documents, you can register yourself (DIY).

Penalty for Not Obtaining GST Registration

Failing to register under GST can attract severe penalties and consequences.

Some penalties are:

-

A penalty of Rs. 10,000 or 10% of the tax due, whichever is higher, for not registering despite being liable to do so.

-

A penalty of Rs. 10,000 or the tax amount, whichever is higher, for collecting GST but not depositing it to the government within three months.

How to Check GST Registration Status?

After Applying for GST Registration you will receive an Application Reference Number (ARN). A GST registration application is processed after 15 days of submission. However, you can check the GST registration status online on the GST portal.

Related Read: Find GST Number Search By PAN

GST Registration FAQs

Who is eligible for GST Registration?

Under Goods And Services Tax (GST), businesses whose turnover exceeds the threshold limit of Rs.40 lakh or Rs.20 lakh or Rs.10 lakh based on the criteria, must register as a normal taxable person. It is called GST registration.

What is registration under GST act?

Registration of any business entity under the GST Law implies obtaining a unique number from the concerned tax authorities for the purpose of collecting tax on behalf of the government and to avail Input tax credit for the taxes on his inward supplies.

The registration under gst is compulsory whose turnover is?

Registration under GST is mandatory for all businesses whose annual turnover exceeds Rs 40 lakhs in a financial year. This threshold is Rs 20 lakhs for special category states such as Arunachal Pradesh, Assam, Meghalaya, Manipur, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand.

How many days for GST registration?

The complete GST registration procedure, including receiving the GST number, takes 7 to 10 working days.

Is GST Registration Mandatory?

Yes, obtaining GST registration is mandatory once your turnover exceeds the specified threshold limits. If you are a supplier of goods with an annual turnover exceeding Rs 40 lakh. In the services sector, businesses with turnover of more than Rs. 20 Lakhs should mandatorily register for GST.

Do I need to submit applications for multiple GST registrations?

If a business operates in more than one state, the taxpayer should obtain a separate GST registration for each state. For instance, If an services company sells in Gujarat and Maharashtra, he has to apply for separate GST registration in Gujarat and Maharashtra.

Can I get multiple GST registrations within a state?

Any business can apply for any number of GST registrations within a state. The procedure of allocating multiple GST registrations only for different business verticals within a state has been removed.

What is a GST identification number or GSTIN?

Each taxpayer is allotted a PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN) in every state that they operate in. It is obtained as a part of the GST registration process. Once the GST registration application is verified and passed by the GST officer, a unique GSTIN is obtained.

How long Should I wait to register under GST?

Any person must get a GST registration within 30 days from the date when they become liable to obtain GST registration and pay GST.

What happens after obtaining the GST registration?

After obtaining the GST registration successfully, the taxpayer will get a GST registration certificate in Form GST REG-06 and a valid GST Identification Number. One will be eligible to avail input tax credit, raise GST-compliant invoices and can file GST returns monthly or quarterly.

How much is the fees for GST registration?

“No fee” is required for registering your business under GST.

Who is not eligible for GST registration?

- Small businesses with annual turnover below the specified threshold limit (currently ₹20 lakhs for most states, ₹10 lakhs for special category states).

- Employees providing services as part of their employment.

- Agriculturists supplying produce from cultivation.

- Entities dealing in exempt goods or services exclusively.

- Individuals supplying goods and services which are not liable to tax under GST.

How many days does it take for GST registration?

GST registration usually takes between 2-6 working days.

Can i file for cancellation of GST registration?

The registration, which is granted under GST, can be cancelled only for a few specified reasons. The cancellation can either be initiated by the department on their own or the registered person can apply for cancellation of their registration. In case of the death of a registered individual, the legal heirs can apply for cancellation.

Is GST filed every month?

The frequency of GST filing depends on the type of taxpayer and the type of return. For example, regular taxpayers with an annual turnover of more than Rs.5 crore must file two monthly returns (GSTR-1 and GSTR-3B) and one annual return (GSTR-9).

How long is a GST registration valid?

The GST registration for regular taxpayers has no expiry and is valid until it is surrendered or cancelled.

Is a bank account mandatory for GST registration?

Yes, a bank account is mandatory for GST registration. As per rule 10A of the CGST Rules, 2017, the newly registered taxpayer has to furnish the banking details within 45 days from the date of registration approval or the due date of filing the first return, whichever is earlier.

Can I modify my GST registration details?

Yes, you can modify your GST registration details through the GST portal by submitting an amendment application.

What is the difference between voluntary and mandatory GST registration?

Voluntary registration is when a business opts to register under GST, while mandatory registration is required by law based on turnover and business activity.

What happens if my GST registration application is rejected?

If your GST registration application is rejected, you will be notified with the reasons for rejection, and you can reapply after addressing the issues.

The post GST Registration Online: Process, Eligibility, Limit, Fees, Documents Required & Penalties appeared first on Razorpay Learn.

]]>The post How to Register for GST Online? A Guide to GST Registration Process Step by Step appeared first on Razorpay Learn.

]]>Similarly, any business that supplies goods exceeding Rs. 40 lakh (or Rs. 20 lakh if the business is located in the States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura, and Uttarakhand) must also undergo GST registration.

Read More: GST Registration Rules and Benefits

Latest Updates on GST Registration Process Online

As per CGST notification no. 13/2024 notified from CBIC dated 10th July 2024

1. Biometric-based Aadhaar Authentication for GST registration, earlier implemented on a pilot basis in Gujarat and Puducherry, has now been extended to the whole of India.

As per CGST notification no. 12/2024 notified from CBIC dated 10th July 2024

2. In cases where applicants do not opt for Aadhaar Authentication, they must submit a photograph of the individual applicant or such individuals in relation to the applicant and get the original documents verified at one of the designated facilitation centres.

A Step-by-Step Guide to the GST Registration Process

New GST Registration procedure is easy and free. A taxpayer seeking a normal registration can visit the GST portal and fill the registration Form GST REG-01.

Registering for Goods and Services Tax (GST) online is a straightforward process that involves a few key steps.

Here’s a comprehensive, step-by-step guide to help you navigate through the GST registration process seamlessly.

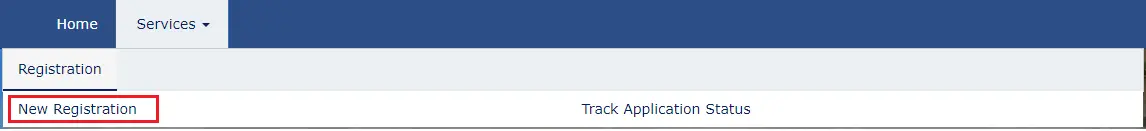

STEP 1: Access the GST Portal

Go to the official GST Portal

STEP 2: Click on “Register Now”

Click on “Registration” under the “Services” tab and then click on “New registration”.

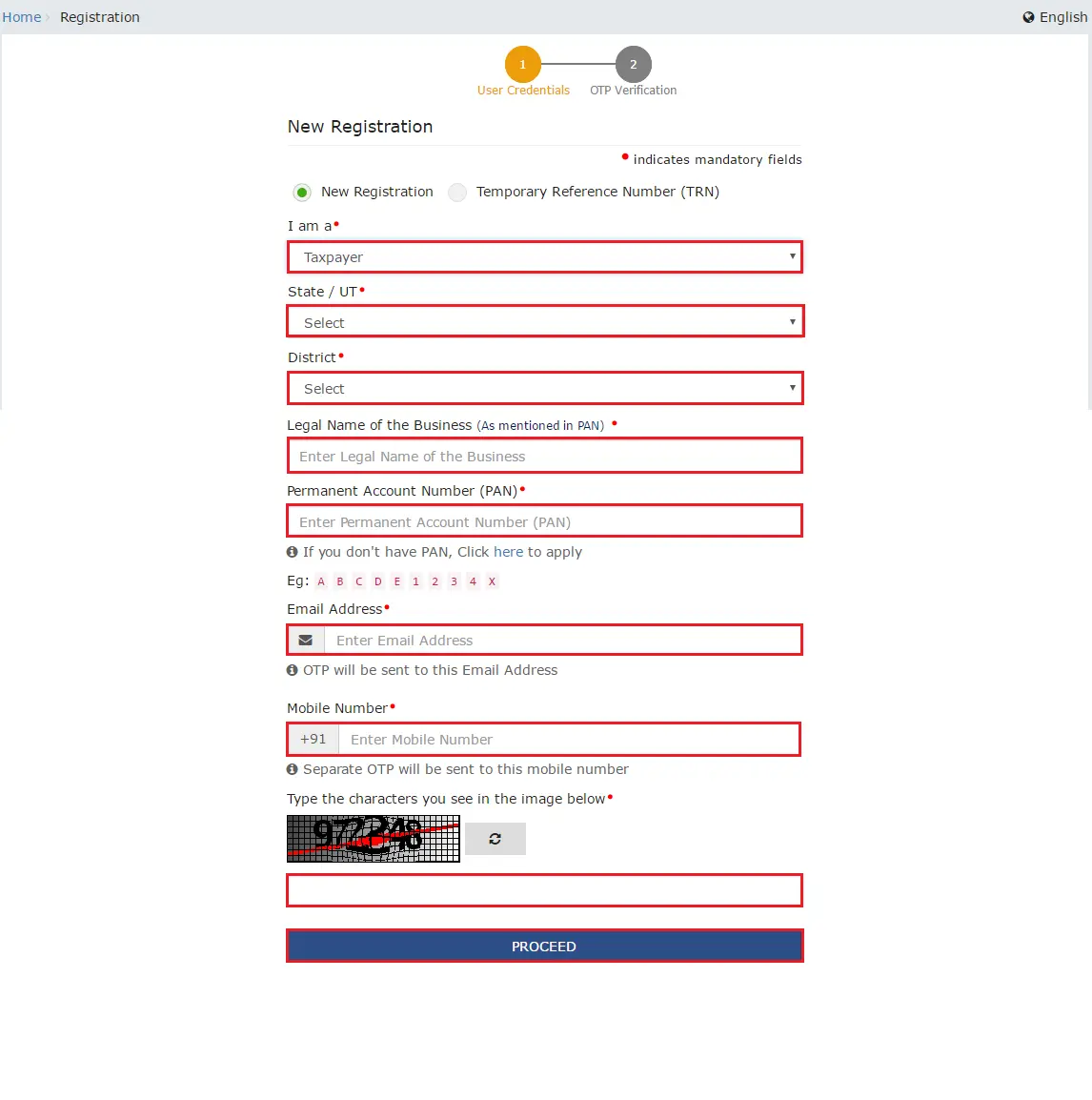

The application form is divided into 2 parts – Part A and Part B.

The application form is divided into 2 parts – Part A and Part B.

Part A

STEP 3: Select Taxpayer

Select the ‘Taxpayer’ as the type of taxpayer from the ‘I am a’ drop-down list.

STEP 4: Select State/UT and District

From the State/UT and District drop-down list, select the state and district for which registration is required.

STEP 5: Enter Business Name

In the Legal Name of the Business field, enter the legal name of the business/ entity as mentioned in the PAN database.

STEP 6: Enter PAN Number

In the Permanent Account Number (PAN) field, enter PAN of the business or PAN of the Proprietor.

STEP 7: Enter Email Address

In the email address field, enter the email address of the primary authorised signatory.

STEP 8: Enter Mobile Number

In the mobile number field, enter the valid mobile number of the primary authorised signatory.

STEP 9: Enter Captcha

Enter the captcha and click the ‘Proceed’ button.

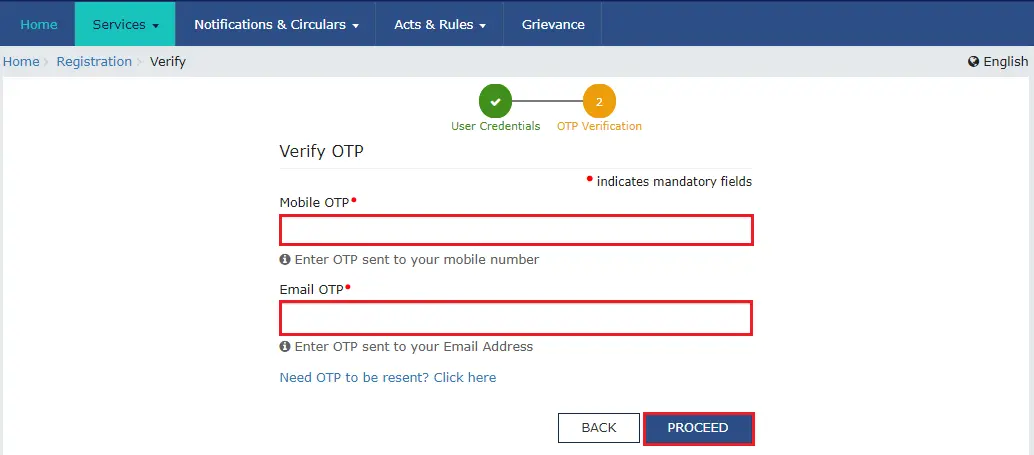

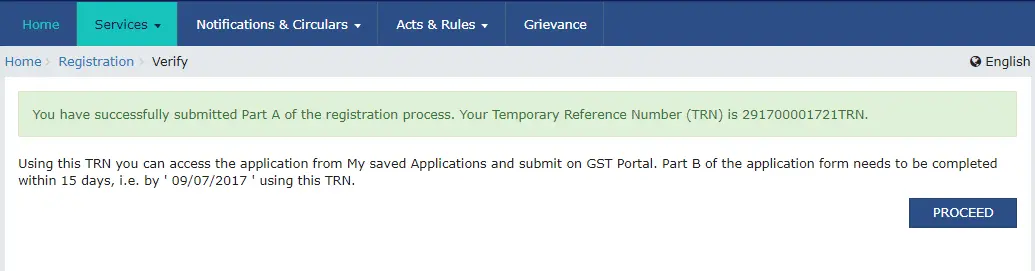

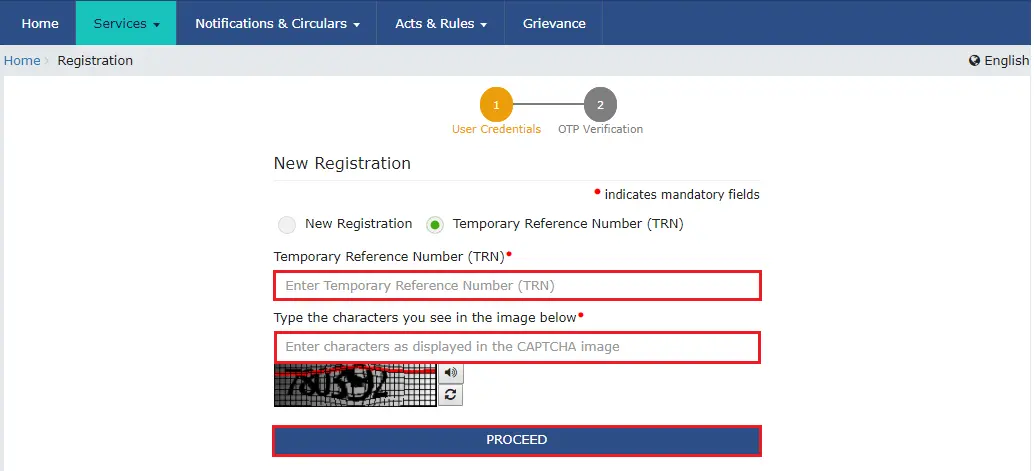

STEP 10: Temporary Reference Number (TRN)

After completing the process, move to Part B. After verification, you will receive a Temporary Reference Number (TRN). The TRN will be sent to the registered email address and mobile number.

Part B

STEP 11: Log in Using TRN

Click on ‘Services’ > ‘Registration’ > ‘New Registration’ option and select the Temporary Reference Number (TRN) button to log in using the TRN.

STEP 12: Enter TRN Generated Captcha

In the TRN field, enter the TRN generated and the captcha text shown on the screen. Then, click on “Proceed”.

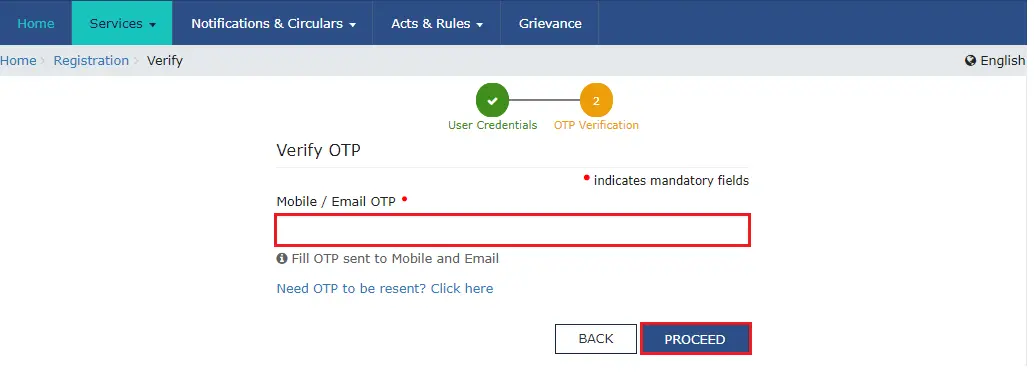

STEP 13: Enter OTP

Enter OTP sent on mobile or email in the verify OTP page. And, click on the ‘Proceed’ button.

STEP 14: My Saved Application

The My Saved Application page is displayed. Under the Action column, click the Edit icon.

STEP 15: Enter Business Details

On the top of the page, registration application form with 10 tabs open. Click on each tab to enter the details like business details, promoter/partner details, authorised signatory, principal & additional place of business, goods & services detail, state information, aadhaar authentication and verification.

STEP 16: Click On Save and Continue

Now click on ‘Save and continue’. Once the application is submitted, sign it digitally using DSC and click on ‘Proceed’

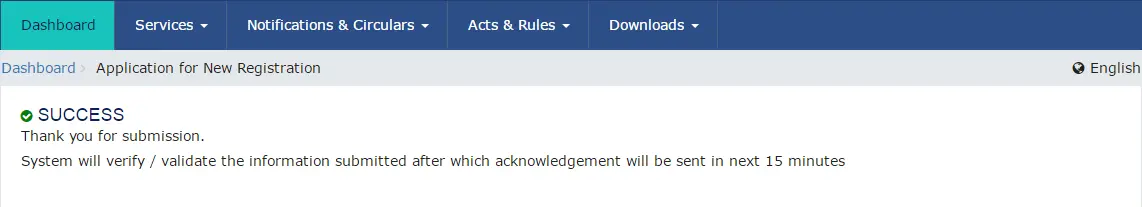

STEP 17: Receive an ARN

After submission, you will receive an Application Reference Number (ARN) via email or SMS to confirm your registration.

GST Registration Via Authentication of Aadhaar

Here’s a step-by-step guide for GST registration via authentication of Aadhaar

STEP 1: Access the GST Portal

Open your web browser and navigate to GST Portal

STEP 2: Initiate Registration Process

Click on the “REGISTER NOW” link on the GST portal homepage, or alternatively, navigate to Services > Registration > New Registration.

STEP 3: Choose Aadhaar Authentication Option

During the registration process, opt for Aadhaar authentication by selecting the Aadhaar Authentication Tab.

STEP 4: Indicate Preference

You’ll be prompted to indicate whether you wish to authenticate your Aadhaar or not. Choose either YES or NO based on your preference.

STEP 5: Authentication Link Generation

If you opt for YES, an authentication link will be sent to the to the registered mobile numbers and email addresses of the Promoters/Partners and Authorized Signatories.

STEP 6: Declaration and Aadhaar Entry

Upon clicking the authentication link, a declaration will appear on the screen. Enter your Aadhaar number and click on “validate”.

STEP 7: OTP Verification

After entering the Aadhaar number, an OTP will be sent to the email and registered mobile number. Enter the OTP in the provided box on the validation screen.

STEP 8: Confirmation

After OTP verification, a confirmation message will appear indicating successful authentication.

STEP 9: Ensure Updated Details:

It’s essential to ensure that your registered mobile numbers and email addresses are updated in Aadhaar for successful authentication.

STEP 10: Verification Process

If you choose NO for Aadhaar Authentication, the GST registration application will be forwarded to the jurisdictional tax authority. They will conduct further steps, including documentary and/or physical site verification, before approving the registration.

STEP 11: Approval Timeframe

If no action is taken by the Tax Authority within 21 days, the GST registration application will be considered approved.

Conclusion

A new GST registration process is crucial for businesses. With a clear understanding of the steps and the procedure involved, compliance becomes seamless. Stay informed, follow the guidelines, and ensure a smooth registration to enjoy the benefits of a transparent and legally compliant business operation.

FAQs

1. Is it mandatory to register for GST online, or can I register offline?

Although registration can be completed through both online and offline channels, the online method is typically favored due to its convenience and effectiveness. Nonetheless, offline registration alternatives exist for individuals who may lack internet access or encounter technical difficulties.

2. How much does GST registration cost?

There is no payable fee upon registering for GST

3. What are the 3 types of GST registration?

The three types of GST registration are:

- Regular taxpayer registration: This type of registration is for businesses whose turnover exceeds the threshold limit set by the GST Council.

- Composition scheme registration: This is for small businesses with a turnover below the threshold limit who opt for the composition scheme, which offers simplified compliance and a lower tax rate.

- GST registration as a casual taxpayer: This is for businesses or individuals who occasionally undertake transactions liable for GST but do not have a regular place of business in the taxable territory.

4. Can I register for GST online if my business operates in multiple states?

Yes, you can register for GST online even if your business operates in multiple states. The online registration process allows you to specify the states in which your business operates and complete the registration accordingly.

5. How long does it take to complete the GST registration process online?

Generally, The entire process of GST registration, including the issuance of the GST number, typically spans from 7 to 10 business days. The duration can vary depending on factors such as the completeness of information provided, verification processes, and workload at the GST authorities.

6. Do I need a digital signature for GST registration online?

Yes, According to GST regulations, all documentation submitted to the government, such as GST registration applications or files uploaded to the GST common portal, must bear digital signatures.

7. Can I track the status of my GST registration application online?

Yes, you can track the status of your GST registration application online using the Application Reference Number (ARN) provided upon submission. The GST portal allows you to check the status in real-time.

The post How to Register for GST Online? A Guide to GST Registration Process Step by Step appeared first on Razorpay Learn.

]]>The post How to Get GSTIN Number Online? Steps to Apply and Create GSTIN Number appeared first on Razorpay Learn.

]]>GSTIN is the abbreviation for Goods and Services Tax Identification Number. It is a 15-digit alphanumeric code assigned to every taxpayer registered under the GST regime. GSTIN is a unique identifier that helps the tax authorities track the tax transactions of different businesses nationwide.

GSTIN Number Example

For example, The GSTIN of Razorpay is 29AAGCR4375J1ZU, where

- 29 refers to the state code

- AAGCR4375J is the PAN of the company/business

- 1 is the entity code number of registrations on PAN in the state

- Z is the default letter

- U is the alphanumeric check code

Every business liable to register under the GST Act must obtain a GSTIN for each state or union territory from which it operates. This number is important for businesses as it enables them to file GST returns, claim input tax credits, issue GST invoices and comply with the GST rules and regulations.

Who Should Apply for GSTIN Number?

As per the GST laws, it is mandatory to register for a GSTIN if:

- Any business with an aggregate turnover over Rs. 40 lakh (for normal category states) or over Rs. 20 lakh (for special category states)

- Any individual has an annual income exceeding Rs. 20 lakh (for normal category states) or exceeding Rs. 10 lakh (for special category states)

- Any business entity or e-commerce company operating in India must have a GST Registration.

- In case some rules do not apply, the business can still register using Voluntary Registration to get GST claims.

Related Read: GST Rules in Detail.

How to Get GSTIN Number Online?

Online GST Registration process is as follows:

STEP 1: Visit the official GST portal and click on New Registration link under Services

Part – A Registration

STEP 2: Under the ‘I am a‘ drop-down menu, select your taxpayer status, such as Taxpayer

STEP 3: Select your respective state and district from the drop-down menus.

STEP 4: Enter the legal name of your as mentioned on the PAN and PAN Number (As mentioned in PAN)

STEP 5: Enter your email ID and mobile number for OTP verification. Ensure they are active and accessible, as they will be used for future communication.

STEP 6: Enter the OTP that was sent to the email ID and mobile number in the respective boxes and Click on ‘Proceed’.

STEP 7: After verification, you will receive a TRN, a Temporary Reference Number. Note it down and keep it safe, as it will be required for Part-B registration.

Part – B Registration

STEP 1: Visit the GST portal again and click on ‘New Registration‘ under ‘Services‘

STEP 2: Select ‘Temporary Reference Number (TRN)’. Enter TRN number generated during Part A registration and the captcha details. Click on ‘Proceed’ button.

STEP 3: You will receive an OTP on your email ID and registered mobile number. Enter the OTP and click on ‘Proceed‘.

STEP 4: The status of your application will be available on the next page. On the right side, there will be an Edit icon, click on it.

STEP 5: Now, Fill in the 10 sections on the screen, such as business details, promoter details, authorised signatory, principal place of business, additional place of business, goods and services, bank accounts, state-specific information, and verification.

STEP 6: UPLOAD the mandatory list of documents mentioned below

- Photographs

- Proof of identity

- Business address proof

- Bank details such as account number, bank name, bank branch, and IFSC code.

- Authorisation form

- The constitution of the taxpayer.

The size and format of the documents may vary depending on the taxpayer’s status and state.

STEP 7: Visit the ‘Verification‘ page and check the declaration, Then submit the application by choosing one of the submission methods: EVC, DSC, or e-Sign.

- By Electronic Verification Code (EVC). EVC is an Electronic Verification Code sent to the registered mobile number or email ID.

- In case companies are registering, the application must be submitted by using the Digital Signature Certificate (DSC). DSC is a Digital Signature Certificate that requires a USB token.

- e-Sign is an Aadhaar-based electronic signature that requires OTP verification. An OTP will be sent to the mobile number linked to the Aadhaar card.

STEP 8: Go to the verification page and check the declaration box. Make sure all the information you provide is correct and complete.

STEP 9: After successful verification, you will see a message on your screen and receive an email confirming your application. You will also get an ARN, which is an Application Reference Number.

STEP 10: Once completed, a success message will be shown on the screen. The Application Reference Number (ARN) will be sent to the registered mobile number and email ID

What is Application Reference Number (ARN)?

ARN It is a unique number that identifies your application and helps you track its GST Registration status.

Keep your ARN for future reference and compliance. It will be required for filing returns, paying taxes, and claiming refunds. Once you are allotted with this number you can always run a GST search by PAN.

Read More: GST Registration and their Eligibility Process

Documents Required to Get GSTIN Number

- PAN Card of the business or individual (Mandatory as the GSTIN number is based on the PAN card number)

- Aadhaar Card

- Proof of registration of the business or incorporation certificate

- Bank details for the account associated with the business or individual

- Passport Size Photograph

- Proof of business address

- Digital signature

In addition to the documents mentioned above, the GST council can ask for additional documents or details based on the requirement for the GST Number for Online Business. It takes 2-6 days for the GST registration process to be completed, within which the registered email or mobile number will get communication from the GST council on any additions required. After that, all documents and forms need to be submitted to the authority as per the deadline provided.

Related Read: How to Get a Business Pan Card?

What Are the Fees to get a GSTIN Number?

Getting a GSTIN number is free of cost for any eligible taxpayer who wants to register for GST. There is no fee or charge for applying online through the official GST portal.

However, there are some scenarios where a taxpayer may have to pay a penalty for not complying with the GST rules and regulations.

Some of these scenarios are:

- Failing to register for GST when required by law.

- Failing to submit GST returns on time or filing incorrect or incomplete returns.

- Failing to pay GST taxes or paying less than the due amount.

- Failing to issue GST invoices or issuing fake or wrong invoices.

- Failing to maintain proper records and accounts of GST transactions.

- Failing to cooperate with GST authorities during audits or inspections.

The penalty amount may vary depending on the nature and severity of the offence. You may have to pay a penalty of 10% of the tax amount due if you have paid a minimum of Rs. 10,000 or 100% if you have tried to evade tax completely. You can easily calculate the tax amount due using Razorpay’s GST Calculator.

How to Check GST Registration Status Online using ARN?

STEP 1: Visit GST official portal at https://www.gst.gov.in/

STEP 2: Click to ‘Services‘ > ‘Registration‘ > ‘Track Application Status‘.

STEP 3: Enter your ARN number and Captcha code. Next click on SEARCH button.

STEP 4: You will receive any of the following GST registration status on your screen

- Provisional status

- Pending for verification status

- Validation against error status

- Migrated status

- Cancelled status

How to Download the GST Registration Certificate?

The procedure to download the GST Registration Certificate is mentioned below:

STEP 1: Visit https://www.gst.gov.in/

STEP 2: Click on ‘Login‘.

STEP 3: On the next page, enter the username and password.

STEP 4: Click on ‘Login‘.

STEP 5: Next, click on ‘Services‘.

STEP 6: Click on ‘User Services‘.

STEP 7: Select ‘View/Download Certificates‘.

STEP 8: On the next page, click on ‘Download’. The certificate will have details of the tax transactions.

Advantages of GSTIN

- Registers your business entity as a supplier of goods or services, helping bring more credibility to your business among customers and partners

- Any individual or business having a GSTIN can file their GST on the portal and take input credit on their business purchases.

- With GST, there are no restrictions to interstate sales and operations all over India.

- Having a GSTIN for an e-commerce website or business will help enhance the seller’s reputation and the scope of the business.

- It simplifies the GST filing process since businesses can file their GST claims on the portal and get a good rating for compliance.

Conclusion

GSTIN is a unique 15-digit alphanumeric code that identifies every registered taxpayer under the Goods and Services Tax (GST) regime. GSTIN plays a vital role in the taxation system, as it enables the authorities to track the tax transactions and compliance of the businesses.

By applying for your GSTIN number, you can enjoy the advantages of GSTIN and simplify your tax compliance. If you have any concerns or hesitations about the application process, visit the official GST portal or contact the GST helpdesk for assistance.

The most important thing is to prepare the necessary documents in advance, as they will determine the success of your application. A well-prepared document set will expedite the application and approval process and help you get your GSTIN number without any hassle.

If you are discontinuing your business, you can proceed with the cancellation of GST registration.

Related Read: How to Download Aadhaar Card By Aadhaar Number, EID, Name And Date Of Birth, VID?

Frequently Asked Questions (FAQs)

1. How do I find my GST number?

You can locate your GST number by visiting the GST portal and logging in with your credentials. Alternatively, you can also use the portal to find the GST numbers of other registered taxpayers by entering their name, PAN or state.

2. How many days will it take to get a GST number?

After submitting the online application, it takes 3-6 working days to get a GST number. However, the processing time may vary depending on the tax authorities’ verification of documents and information.

3. Who is not eligible for GST registration?

The following persons are not eligible for GST registration:

- Persons who are making only exempt supplies are not liable for GST.

- Individuals who only provide goods or services that fall under the reverse charge mechanism, where the recipient is responsible for paying GST.

- Agriculturists who are engaged in the cultivation of land and supply of agricultural produce

4. Can I take 2 GST numbers in one state?

No, you cannot take 2 GST numbers in one state for the same PAN. However, you can obtain separate GST numbers for different business verticals within the same state, subject to certain conditions and approval by the tax authorities.

5. Can I sell different products with the same GST number?

Yes, you may sell various products with the same GST number if they fall under the same category of goods or services. You must mention the HSN or SAC code of each product or service in your invoice and GST returns.

6. Can I use GST for personal purchases?

No, you cannot use GST for personal purchases. GST applies to the goods or services supplied/provided during business. Personal purchases are not considered business transactions and are not subject to GST.

The post How to Get GSTIN Number Online? Steps to Apply and Create GSTIN Number appeared first on Razorpay Learn.

]]>The post GST Rates in 2024 – Check Full List of Goods and Service Tax Rates, Slabs & Revisions appeared first on Razorpay Learn.

]]>GST Rates in 2024 – GST Structure & Present Slabs of GST in India

The Central Board of Indirect Tax and Customs (CBIC) divides the present slabs of GST rates in India into five categories: 0%, 5%, 12%, 18%, and 28%. Additionally, some goods and services are subject to a cess, which is a surcharge levied over and above the GST rate. It is levied to compensate the states for any revenue loss due to the implementation of GST rules.

The primary GST slabs applicable to regular taxpayers are 0%, 5%, 12%, 18%, and 28%. There are also less commonly used rates, such as 3% and 0.25%. Additionally, taxable composition persons are required to pay General Service Tax at lower or nominal rates, ranging from 1.5% to 6% on their turnover.

Latest Read: All About 54th GST Council Meeting Highlights and Latest Updates

New GST Rates List in India for 2024

Between 2023 and 2024, GST tax rates changed for many products and services. Below are the details of these changes.

| Category | Old GST Rates |

New GST Rates

|

| Railways Goods and Parts under Chapter 86 | 12% | 18% |

| Pens | 12% | 18% |

| Metal Concentrates and Ores | 5% | 18% |

| Certain Renewable Energy Devices | 5% | 12% |

| Recorded media reproduction and print | 12% | 18% |

| Broadcasting, sound recordings, and licensing | 12% | 18% |

| Printed material | 12% | 18% |

| Packing containers and boxes | 12% | 18% |

| Scrap and polyurethanes | 5% | 18% |

As per Press Information Bureau , Below the GST rate recommendations made at the 53rd GST Council Meeting held in June 2024.

Items |

Old Rate |

New Rate |

| A uniform rate for all types of milk cans | – | 12% |

| A uniform IGST rate applies to imports of aircraft tool kits | – | 5% |

| Carton boxes and cases | 18% | 12% |

| All types of solar cookers | 5% | 12% |

| A uniform rate for all types of sprinklers | – | 12% |

| Indian Railways – Platform tickets | – | Exempt |

| Indian Railways – Facility of retiring rooms/waiting rooms | – | Exempt |

| Indian Railways – Cloak room services | – | Exempt |

| Indian Railways – Battery Operated car services | – | Exempt |

| Hostel accommodation service under certain conditions | – | Exempt |

Latest GST Rate Revision in 53rd GST Council Meeting

The 53rd GST Council meeting was held on 22nd June 2024. The meeting was chaired by Union Finance Minister Nirmala Sitharaman, who announced several recommendations to the existing GST list.

53rd GST Council Meeting Highlights

Below are the highlights of the 53rd GST Council Meeting held in June 2024

- A uniform GST rate of 12% is announced for all milk cans, regardless of the material such as steel, iron, or aluminium.

- A 12% GST rate applies to all solar cookers, whether they use a single or dual energy source.

- A 12% GST rate applies to all solar cookers, whether they use a single or dual energy source.

- A 12% GST rate is applied to all types of sprinklers, including fire and water sprinklers.

- A uniform rate of 5% IGST will be applied to the import of parts, components, testing equipment, tools, and toolkits for aircraft, regardless of their HS classification.

- The 53rd GST Council meeting has exempted certain GST rates on services offered by Indian Railways. These include the sale of platform tickets, access to retiring rooms/waiting rooms, cloakroom services, and battery-operated car services. Additionally, intra-railway transactions are now exempt.

- The GST rate is exempted for hostel accommodation services under certain conditions. Students and working professionals who reside in off-campus hostels for a continuous period of 90 days and pay a monthly rent of INR 20,000 per person are eligible for this exemption.

GST Rates Increased in 52nd GST Council Meeting

Items |

Old Rate |

New Rate |

| Scrap and polyurethanes | 5% | 18% |

| Printed material | 12% | 18% |

| Broadcasting, licensing, and sound recordings | 12% | 18% |

| Several renewable energy devices | 5% | 12% |

| Railways goods and parts under Chapter 86 | 12% | 18% |

| Metal concentrates and ores | 5% | 18% |

| Packing containers and boxes | 12% | 18% |

| Pens | 12% | 18% |

| Recorded media print and reproduction | 12% | 18% |

GST Rates Decreased in 52nd & 53rd GST Council Meeting

Items |

Old Rate |

New Rate |

| Carton boxes | 18% | 12% |

| Indian Railways (Platform tickets, retiring rooms/waiting rooms, cloak room services and battery-operated car services) | – | Nill |

| Hostel accommodation services for students and working professionals | – | Nill |

| Keytruda for cancer treatment | 12% | 5% |